“O.itemList.length” “- this.config.text.ariaShown

“This.config.text.ariaFermé”

The S-P 500 is only 1% of its all-time high and investors seem to have no sign of avoiding their shopping frenzy. Low interest rates and strong government stimulus support equity markets, making stocks more valuable than other investments. As stock markets can show, the economy is on track to recover from the coronavirus recession.

And Credit Suisse, a world-famous investment bank and money provider, has been busy looking at publicly traded companies, probably looking for winners under existing conditions. The company’s analysts have decided on 3 of the company’s first-choice stock, which are expected to get better results in the next 6 to 12 months.

When we opened the TipRanks database, we extracted the main points of those moves to locate what makes them so attractive. Here are the results.

Cimarex Power (XEC)

We will begin with Cimarex, founded in Denver, an oil and fuel exploration company with drilling operations in New Mexico, Texas and Oklahoma. The corporate closed 2019 with 620 million barrels of reserves shown and an average daily production of 278,500 barrels of oil equivalent. It was a forged base, which helped help companies in the 1S20 crown crisis.

The economic slowdown of recent months has hit Cimarex hard as demand for oil has fallen. The company saw its profits contract in the first quarter and contract in the current quarter. Production at the time of the quarter averaged 254.7 thousand barrels of oil consistent with the day, well below 2019 levels.

However, there was good news. The Company generated $145 million in operating money and invested $84 million in the quarter, adding $49 million for drilling and well completion. The company’s balance sheet is solid, with no loans on the renewable line of credit, and although there is an ongoing $2 billion debt, promissory notes do not expire until 2024. Cimarex ended the current quarter with a $44 million money balance and loose money flow. $26 million. after funding the dividend.

Split finishes are an apparent charm for investors. The company reported the existing payment, which expires later this month, of 22 cents, consistent with a consistent non-unusual percentage, more than at the end of last year. The yield, at 3.2%, is well above average.

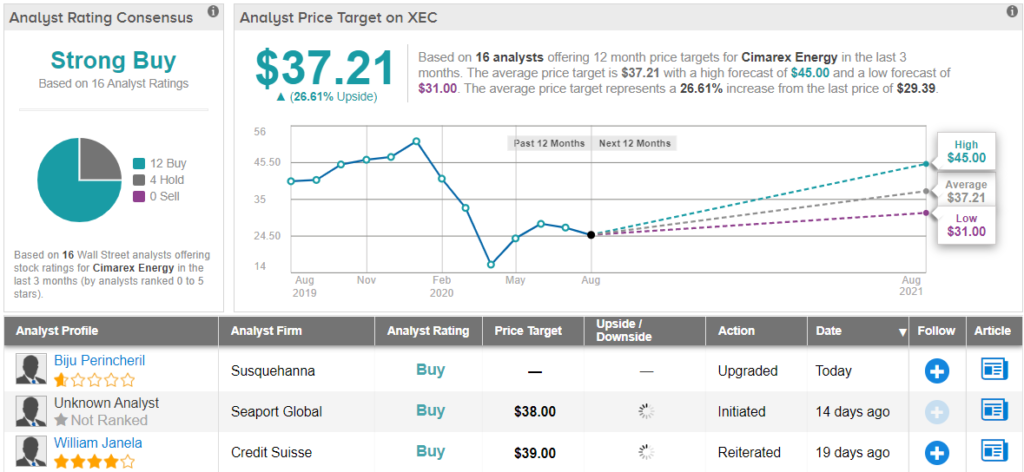

William Janela, a 4-star analyst at Credit Suisse, wrote the review of XEC companies and was inspired by the latter: loose money and dividends. He said in his note: “XEC is our first selection among THE SMID-cap EP given a defensive balance (investment grade, fully unarmed revolver of $1.5 billion, with no debt in adulthood until 2024), a commitment/ability to finance capex and an -average yield of dividends in money and an exciting relative valuation.”

To this end, Janela values XEC as a superior return (i.e. a purchase), as well as a value target of $39. This figure suggests that inventory has room to expand to 33% from existing levels. (To view Janela’s review, click here)

Overall, Cimarex has a moderate purchase note of the analyst consensus, based on 12 purchases instead of four catches. The existing percentage value is $29.10 and the average target of $37.08 implies a prospective increase of 27%. (See Cimarex inventory market research at TipRanks)

Flowering energy (BE)

Bloom Energy, a publicly traded company since 2018, is an actor in the energy market. The company produces and sells forged oxide fuel cells, a cleaner option than fuel or classic batteries.

Bloom saw wrought effects in the first part of the year, despite the coronavirus. The company reported earnings in the second quarter of $187.9 million, as well as 306 visitor acceptances. This last measure led to a sequential increase of 19.5% and an increase in new business. The company’s shares rose in July, well above pre-market collapse levels, and even after a fall in early August, BE shares remain high.

The Company announced on August 6 that it would offer $135 million in senior convertible notes maturing in 2025. The new debt will be used to pay a series of notes at 10% maturing next year, converting long-term debt into debt. This resolution is somewhat stabilizing for the company.

Michael Weinstein, five stars on Credit Suisse, sees a transparent trail for Bloom in the future. He writes: “We expect shipments to grow in the short term due to a strong call for reliablely strong wildfires. New opportunity for bloodless season and a continuous call for knowledge centers/hospitals. Bloom Energy’s fuel cells run on fuel today and can take on the merits of cheap herbal fuel, disimilants emerged last month (ship fuel cells, hydrogen fuel cells and electrolytes) that position Bloom Energy as a key manufacturer of elements that make up a hydrogen economy.”

Weinstein’s acquisition note is backed by its $24 value target, implying a strong year-on-year increase of 87% for stocks. (To view the Weinstein review, click here)

In general, BE has a moderate acquisition of analyst consensus, with 3 purchase notes and 2 takes. The average value target of $17.25 represents a 33% increase over the existing percentage value of $12.97. (See Bloom action research in TipRanks)

Ashland (ASH)

The latest on our list today, Ashland, is a specialized chemicals company founded in Kentucky, which generates solvents, compounds and commercial specialties, as well as home and non-public care products, prescription drugs and agricultural chemicals. The corporate reported strong gains in the first part of the year, with revenues above forecasts at the time of the quarter despite a 6% year-on-year decline in sales.

Ashland has noticed positive aspects of the balance in its recent results. The flow of free money more than doubled from year to year to $353 million, while long-term debt fell by 33%. The Company generated $47 million in trade money, an accumulation of $15 million during the last quarter. Overall, the strong monetary position supported businesses during the economic crisis.

4-star analyst Chris Parkinson, who writes Credit Suisse’s opinion about Ashland, sees the company as a successful company. It provides the inventory with a purchase note, and its $91 value target indicates confidence, and 15% prospective for inventory. (To view the Parkinson’s review, click here)

In his opinion, Parkinson writes: “ASH has demonstrated its ability to temporarily realign advertising purposes from a vertical design to a horizontal design, which promotes an advanced combination and will lead to increased costs/responsibility of ROIC (changes in composition design) ASH continues to take advantage of cost-cutting opportunities and improve FCF conversion will provide long-term investment opportunities. »

Overall, Ashland has a strong acquisition of consensus analysts, in nine reviews, adding 7 acquisitions and 2 catches. Inventory is quoted at $7nine.44, and the average value target of $88.50 suggests an accumulation of about 11%. (See Ashland’s action investigation on TipRanks)

To locate intelligent inventory trading concepts with exciting valuations, check out inventories to buy from TipRanks, a newly introduced tool that collects all tipRanks stock data.

Disclaimer: The reviews expressed in this article are only those of the featured analysts. The content is intended to be used for data purposes only. It is very important to do your own research before making any investments.