Sign up for the most productive news and knowledge about herbal gases. Follow the topics you need and get emails.

Editor’s Note: The Mexican Gas Price Index of NGI, a leader that follows the reform of the Mexican herbal fuel market, presents Eduardo Prud’homme’s next column as a component of a normal series on this process.

Prud’homme played a central role in the progression of Cenafuel, the national pipeline operator, an entity created in 2015 as a component of the energy reform process. He began his career at the national oil company Petreeos Mexicanos (Pemex), worked for 14 years at the Energy Regulatory Commission (CRE), a leading environmentaliclist in adjustment, and from July 2015 to February was ISO Director of Cenafuel, where he oversaw the , advertising and economic control of the built-in herbal fuel formula (Sistranfuel). Based in Mexico City, he runs Mexican energy consulting firm Gadex.

The perspectives and positions expressed through Prud’homme necessarily reflect the prospects of NGI’s Mexican fuel value index.

The concept of exporting herbal fuel from Texas to East Asia through pipelines across Mexico has long existed. Thus, the long reaction of Mexican President Andrés Manuel López Obrador on August 10 to some questions from the hounds on this subject is not topical. Still, the president’s words were revealing, and given that mexico’s policy today focuses on one-man revelations, he might recommend some things applicable to the herbal fuel market and perhaps even lead to new investment opportunities.

In what ended up being about thirty minutes of sinuous answers to questions of power, Obrador gave his vision of the herbal fuel industry in Mexico. His comments were an addition of accusations and allusions to the renegotiation of last year’s fuel contracts, but he also discussed 3 sites on the Pacific coast that can be used to export U.S. fuel to Asia and even Central America. These sites were Ensenada, Topolobampo and Salina Cruz. He said the concept of exporting fuel is a solution to “a legacy problem” and a way to use excess fuel acquired “in a smart advertising proposal for the personal sector.” All of this is a component of your government’s commitment to “honoring contracts.”

He said the development of poor and abnormal plans had led Mexico to sign fuel contracts to obtain thermoelectric power plants that were never built. His government, he said, is obliged to solve this problem, and send liquefied herbal fuel (LNG) from Mexico, although pipeline price lists are expensive, it is a smart solution in components because Texas fuel is “the cheapest in the world. “Matrix”

President Obrador also took the opportunity to accuse the past government and the personal sector of making poor plans for the pipeline’s course. That’s why, last weekend, he promised the Yaquis de Sonora the option to modify the meaning of the 510 Mpi3/J blocked Guaymas-El Oro pipeline belonging to IEnova, the Mexican subsidiary of Sempra Energy in California. It will be expensive, but you will charge more for not completing the pipe. Here, he did not miss the opportunity to criticize the contracts signed through the state public service, the Federal Electricity Commission (CFE), which will have to pay this corporate for every day the pipeline does not work.

It is incredibly attractive that the President has connected the entire operation of the Ssabe-Guaymas-El Oro segment with the need for combustible materials in Topolobampo. It is there, according to his statements, that his government is contemplating “companies” building an LNG plant to export to Asia. In direct reference to Sempra, he noted that a company wants a permit to export fuel to Japan from its Ensenada plant. In a geographical leap of several thousand kilometers, in his next sentence, he said that the export of fuel can also take up position in Salina Cruz, but this time Gulf fuel. To do this, the existing pipeline can be used on the isthmus and possibly the allocation would come with the fuel source to Central America.

In his informal and conversational style, the President reviewed the plans and presentations already proposed through CFE, Petróleos Mexicanos (Pemex) and pipeline operator Cenafuel. It is true that the monetary pressure resulting from the purchase of fuels and fuel shipping contracts is real. Advertising control of Mexico’s entire fuel portfolio is complex. CFE is the largest player in the fuel market in Mexico and has a disproportionate weight in fuel transactions in Texas after a series of contracts signed over the past decade, even before the 2013-14 energy reform. Obrador is right to point out the presence of excess fuel in the CFE procurement portfolio, as well as an underutilization of reserved capacity in other systems with other personal companies.

However, your research has the right context.

The design of the CFE-anchored pipeline formula was supported by medium- and long-term analysis, and it was never assumed that they would be complete from the start. In addition, the capacity of the pipeline should respond to intake spikes over time and not be limited to medium levels. This is even more applicable on a network that lacks garage capacity.

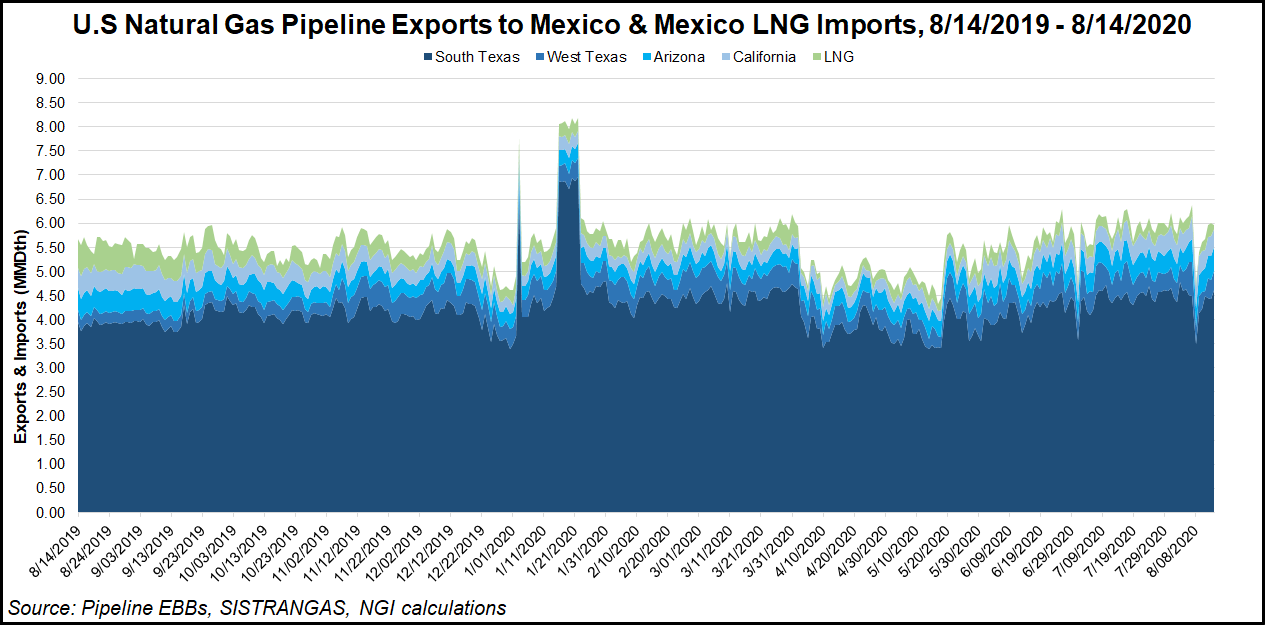

There are undeniable seasonal elements and expansion trends. The call for expectations a few years ago was based on a systematic shortage scenario in which many consumers, both electrical and non-electric, were simply not serviced through the Sistranfuel pipeline network. Domestic fuel production was declining. In the calculations of the plan development models, an annual expansion of around 400 to 500 MMCf/d was estimated. Each prognosis is fallible, however, by analyzing this year’s data, even in a pandemic environment, we can see a healthy expansion. From January to June 2020, the construction flow of the Ssabe-Guaymas pipeline went from 67 Mpi3 /da 153 Mpi3/d. In the Ojinaga-Encino system, fuel injections increased from 111 mpi3/d. At the San Isidro-Samalayuca pipeline, injections were increased from 80 Mpi3/da 230 Mpi3/d. The commissioning of the maritime pipeline also contributed particularly to the accumulation of imports from Texas.

It is also vital to note that the geographical layout of the pipelines not only took into account the appropriate routes, but also aimed to create a mesh formula that would give reliability and continuity of service. The scale of the Mexican market is not enough to see a proliferation of pipelines as in the rest of North America, where urban call centers connect through other lines with other origins. The underlying concept in the presentation of Mexican projects introduced over the last decade was to address the lack of access that made the main cities of the country vulnerable. It should be remembered that in July 2007, a radical left-wing guerrilla organization caused an explosion in a Pemex pipeline that left the Bass region fuel-free and that there was no other way to store combustible materials for all types of users in the region. .

Many main logistical points were also ignored in Obrador’s statements. For Sempra to start exporting fuel to Asia from the Energea Cote d’Azur terminal, you don’t just need an export permit. There is also uncertainty around the expansion of the Rosarito pipeline and contractual coordination with other upstream players to succeed in greater capacity on the existing north-east line, owned by TC Energy. Lack of fuel transmission capacity in the region for power generation projects is no easy task. Baja California’s interconnected electrical formula is in constant emergency.

For Topolobampo to become a new basis for exports to Asia, it is also vital to be transparent about the economic logic at issue. Achieving LNG competitiveness requires explaining industry price lists and margins. When Obrador talks about asking corporations for assistance through tenders, it is vital that waha’s submission to Topolobampo situations be transparent. Will it be a traditional rate, a regulated rate, or a move from the payment program agreed between IEnova and CFE? For Salina Cruz to be a starting point for the Central American fuel source, we want to know if the capacity will be allocated in the direction of Nueces, Texas to Montegrande and from there to the Jaltipán-Salina Cruz line. It is more vital to explain whether PEmex’s CFE or fuel trading branches will be involved in the design of the source chain or whether there will be a partial or full share of personal corporations.

The new LNG features certainly open up a gateway to advertising opportunities in the Mexican fuel market. However, the main implementation points are essential. To be sure, many actors will appreciate the measure, but the market would appreciate it more if the paintings of the correct institutional plans and the implementation of open and transparent tenders were the basis for investment in projects that are not only vital for Mexico, but also strategic. North American Region.

Download the PDF edition