Pacific Ethanol surprised Wall Street with its 2020 quarter earnings report and a strong EBITDA outlook adjusted for the 2020 part.

The Company generated $28.8 million in adjusted EBITDA at the time of 2020 and guided the WO program. EBITDA at $60 million (using the midpoint).

Given his new perspective on ADJ. EBITDA perspective, PEIX will be able to renew and decrease its net debt through $163 million, which revalue the stock.

As an investor and market student, 2020 is my most productive investment year, as I have evolved more this year than any other year in the last twenty years. Much of this evolution has used the eye of my active mind to synthesize existing data and trends and make foreboding market forecasts.

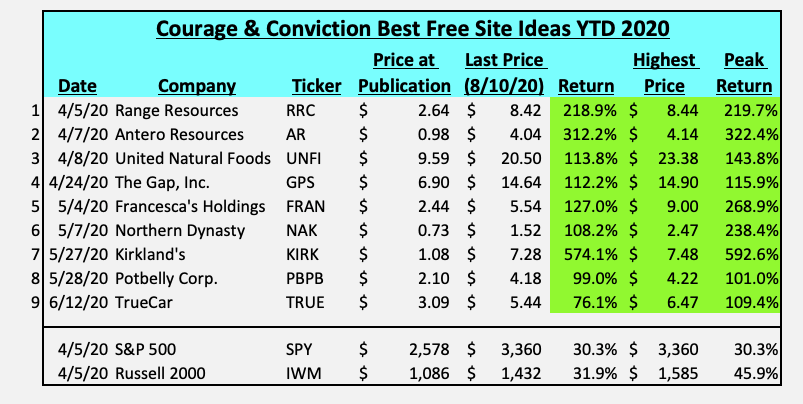

For example, on the loose site (since the beginning of the year in 2020), I have a percentage of at least nine items where the percentage value of the underlying inventory is higher up to at least one hundred percent between the time of publication and its highest point. this year (after publication).

Over the years, I discovered that my ego was right about me because I didn’t know how to suffer a loss when my thesis wasn’t working (see “Taking my medications (loss)”).

This active, open brain eye led me to buy Pacific Ethanol Inc. Inventories (PEIX) after August 11 business hours. At first glance, many market participants think I’ve just lost my brain; After all, just take a look at parabolic inventory graph. Jokes aside, I am fully aware that as recently as July 22, PEIX inventories were quoted at less than $1 according to the stock.

“Our strong quarterly monetary effects, which add a net revenue stream of $14.6 million and an adjusted EBITDA of $28.8 million, were driven through our diversified product portfolio and increased high-quality alcohol production,” said Mike Kandris, co-CEO of Pacific Ethanol. . “Our Beijing campus has been generating industrial, chemical and beverage grade alcohol for over a hundred years, and we recently announced an expansion of our production capacity to meet the request for our high-quality alcohol used in disinfectants and disinfectants, which has a higher one particularly due to the ongoing coronavirus pandemic. We also continue to see strong demand for our high-priced food and feed products, which our Beijing services have been generating for over 20 years. “At this time of year, we are expecting adjusted EBITDA to be between $50 million and $70 million, with momentum until 2021,” said Bryon McGregor, Chief Financial Officer of Pacific Ethanol.” In addition to reducing our debt through $34.4 million in the current quarter, we continue to paint with our finalists to fulfill our continued legal responsibility to agree on a plan to eliminate or refinance our term debt. To that end, our purpose is to reduce our overall notable term debt at the end of the fiscal year through at least $70 million. We believe that continued debt relief and successful expansion will position us well to generate long-term expansion and price for our shareholders. (Source: Pacific Ethanol Effects Publication Q2 2020)

These two paragraphs are a game changer. I very much doubt that many market participants knew that the Beijing department inherited from PEIX guilty of the manufacture of high-quality alcohol used in disinfectants and disinfectants. I know you don’t!

Unless you’ve lived under a rock, the vast majority of people know that Clorox wipes, disinfectants and hand sanitizers (CLX) have been rare since the start of the COVID-19 pandemic. If I had had more wisdom about PEIX’s business segments, I would have fixed the points. That said, frankly, like the top players in the market, I also believe that PEIX would only register its balance sheet in 2021, because its debt and lack of strength from EBITDA (before the last quarter of 2020) would make it extremely inevitable.

“In addition to cutting our debt by $34.4 million this quarter, we continue to work with our finalists to fulfill our continued legal responsibility to agree on a plan or refinance our term debt. To do this, our purpose is to reduce our overall noticeable term debt until the end of the fiscal year to at least $70 million.

Annex A

(Source: PEIX Q1 2020 10-Q)

Annex B

On December 15, 2016, Pacific Ethanol Pekin, LLC or PE Pekin signed term and renewable lines of credit. PE Pekin borrowed $64.0 million from a term line of credit due August 20, 2021 and $32.0 million from a renewable line of credit due February 1, 2022 (Source: PEIX Q1 2020 10-Q)

Annex C

Under this amendment, PKI, together with PEkin, agreed to pay lenders a total of $40.0 million until September 30, 2020 for notable and notable loan balances under PKI and PE Pekin’s credit agreements. (Source: PEIX Q1 2020 10-Q)

Although consistent percentages were traded at less than $1 consistent with the consistent percentage on July 22, after carefully reading its publication on the effects of the 2020 quarter in conjunction with a review of the company’s 10-Q to better assess its debt profile, I collected a relatively small amount of PEIX consistent with percentages in the inventory exchange on August 11. Depending on where the consistent percentages are negotiated at the beginning of the action on August 12, I can opportunistically charge some more consistent percentages.

Second Wind Capital is a service aimed at catalysts and trading with a base connected to prices and disadvantaged sectors. The era of detention can range from a few days to six months (sometimes more if my point of conviction for a specific thesis is superior and fundamental and tangiblely intact). Risk control perimeters based on position sizing and/or preventing losses will be explained. No one beats a thousand, so if you can get it right 51% of the time and manage your risk, generate large returns. Register now with a 2-week drop-off trial and stick to my wallet in real time.

Disclosure: I am/ are long PEIX. I wrote this article myself and expressed my own opinions. I don’t get any refund for this (apart from Seeking Alpha). I don’t have any dating announcements with a company whose action is discussed in this article.