Erik Khalitov

Warner Bros. Discovery, Inc. (NASDAQ: WBD) continued to see major weakness in its percentage price, with its market capitalization again approaching $20 billion. The company’s percentages have fallen more than 65% since its initial public offering while dealing with AT’s debt.

Warner Bros. Discovery continued to struggle in the high-end segment, but advanced in the power of its portfolio.

Warner Bros. Discovery Investor Presentation

The company reported earnings of $10. 3 billion for the quarter, a 7% decline in earnings as well as a 5% decline in adjusted EBITDA to $2. 5 billion. However, the company managed to post more than 30% growth in reported FCF, to $3. 3 billion for the quarter. This annualized FCF return represents an FCF return of more than 50% to market capitalization, reflecting the company’s financial strength.

From a year-on-year perspective, the company saw its profit fall 4% to $41. 3 billion. However, the company managed to increase adjusted EBITDA by 12%, to more than $10 billion. Year-over-year, FCF nearly doubled to $6. 2 billion. up from $3. 3 billion a year earlier. This is essential for the company to continue generating returns for its shareholders.

The corporate segment shows some persistent weakness, but shows its ability to continue operating.

Warner Bros. Discovery Investor Presentation

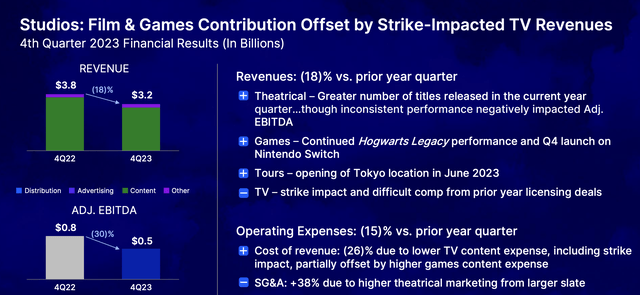

The company’s studios segment saw an 18% quarterly profit drop, affected by the TV strike, with strong results in each and every segment, such as cinema and gaming. Operating expenses have also been helped by the effects of the strikes, but the company’s larger workforce means that promotional, administrative and promotional expenses remain high. Adjusted EBITDA fell 30% to $500 million.

Warner Bros. Discovery Investor Presentation

The company’s networks segment saw a smaller 8% drop in revenue, but this had a bigger impact on adjusted EBITDA, with an 11% drop to $2. 2 billion. The company had fewer pay-TV subscribers in the U. S. , as well as the effect of the ex-TA measure

This is a fundamental fear that should be heeded. Advertising is moving more and more online, and the company wants to be able to demonstrate its ability to attract advertisers to its programs. In fact, the profit rate declined, but with significant constant expenses, it wasn’t enough to curb a larger drop in EBITDA.

Warner Bros. Discovery Investor Presentation

Direct-to-consumer service, or DTC, is the main plus point of the company’s portfolio. The total number of DTC subscribers stands at 100 million, and the company has noticed that its global average profit based on the user, or ARPU, is increasing. Overall profits increased and advertising remained strong despite some hiccups in terms of transitory licensing. Current expenditure also declined.

This led to a 3% year-over-year increase in earnings, as well as a large adjustment in EBITDA that turned positive again. Seeing positive EBITDA in this segment would be an exciting step.

Warner Bros. Discovery continues to have a lot of debt, with a debt of just under $40 billion.

Warner Bros. Discovery Investor Presentation

The company holds all of its debt at a constant interest rate, better in an emerging interest rate environment. The company’s average return is 4. 6%, with more than $10 billion expected in 2050 and beyond, and another $10 billion in 2040 and beyond. The company has continued to pay down its debt aggressively, paying a whopping $5. 4 billion in 2023.

The company’s additional debt matures, which means that the company can pay off its debt before it matures. The 4. 6% rate represents about $1. 8 billion in annual interest, a manageable point for the company that will be minimized as it pays off its debt. . The debt point is high but more than manageable, even if it is more than double the market capitalization.

Investors hate the company right now. Warner Bros. Discovery, Inc. It is now priced at $8. 5 per share, near a 52-week low of more than $8 per share. This puts the company at 5% of its 52-week low.

The company’s market capitalization has now fallen to about $20 billion. The company now has debt that doubles its market capitalization. The company has continued to generate large FCFs and its debt is subject to a minimum refinancing requirement. The company can pay off its debt as it matures, saving modest interest expenses while maintaining liquidity.

The company’s biggest threat remains whether it will be able to stem the decline in profits and EBITDA, and show stability or improvement across the board. Once the company achieves this, it will be able to use its excess money for shareholder gains. This makes the company a valuable long-term investment.

The biggest threat to our thesis is the decline of some key areas of the company’s business. The company wants to slow down and prove that not only can it improve FCF, but that earnings and overall margins can remain strong over the long term. This is imperative for the company to generate long-term returns for shareholders.

Warner Bros. Discovery, Inc. has recently experienced excessive weakness, but we are now adding 1,000 shares to our position. It remains to be noted that if this materializes, the venture is obviously a popular action at this point. However, the company has been rushing to launder its monetary results, generating strong cash flows, and its debt is manageable.

The company will have to curb the weakness of its turnover. If you’re successful, you’ll be able to keep paying off debt and use your cash flow to pay dividends or buy back percentages. This is something the company can comfortably afford, but it remains to be seen if it will come to fruition. Please share your thoughts in the comments below.

The Retirement Forum offers concrete ideals, a secure, high-yielding retirement portfolio, and macroeconomic insights, all for you to maximize your capital and income. We explore the entire market to maximize your profitability.

Recommendations from one of the authors of TipRanks at 0. 2%!

Retirement is confusing and you only have one chance to get it right. Don’t miss this opportunity because you didn’t know what was there.

Provide:

Click to get our discounted 2-week free trial!

This article written by

Value Portfolio specializes in construction retirement portfolios and uses a fact-based strategy to identify investments. This includes detailed 10K readings, analyst commentary, market reports, and investor presentations. It invests genuine cash in the stocks it recommends.